Bitcoin Cycle Data: Unlocking the Next Explosive Bull Run - Bullish AF

2025-12-01 15:18:204

Okay, buckle up, because I'm about to tell you why all the doom and gloom you're hearing about Bitcoin's "death cross" is, frankly, a load of hooey. Everyone's hyperventilating about this technical indicator, claiming it signals a market bottom, but let's dive into the *real* story the data is telling us. Forget the fear-mongering headlines; the future is looking incredibly bright, and I'm talking *potentially $200,000 per Bitcoin* bright.

Death Cross? More Like a Launchpad!

Beyond the Hype: Data-Driven Optimism First off, let's address the elephant in the room: this so-called "death cross." Yes, the 50-day moving average might dip below the long-term average, but as James Van Straten rightly pointed out, previous death crosses have actually marked *major bottoms* for Bitcoin. Think about that for a second! It's like the market is having a little dramatic moment before launching into the stratosphere, a feint before the knockout punch if you will. But what's even more interesting is what the on-chain data is telling us. We're not just relying on simple moving averages here; we're looking at the *heartbeat* of the Bitcoin network itself.New Money's Vote: STH Price as Bitcoin's Confidence Barometer

Short-Term Holder Realized Price (STH) as a Support Indicator One of the most compelling indicators is the Short-Term Holder Realized Price (STH). Imagine it as the average cost basis for all the new kids on the block, the recent investors. Historically, this level acts as a dynamic support and resistance zone. Right now, it's hovering around $113,000, pretty close to where Bitcoin is trading. And get this: when Bitcoin holds *above* this STH realized price, it signals that the average newbie is either breaking even or in slight profit. This, my friends, breeds confidence and encourages even *more* capital to flow into the market. It’s like seeing your neighbor make a killing on a stock; suddenly, you want in too.$200K Bitcoin? The Future is Calling!

Short-Term Holder MVRV Ratio and Potential Resistance Zones But wait, there's more! Let's talk about the Short-Term Holder Market Value to Realized Value (MVRV) Ratio. This nifty little ratio helps us understand if Bitcoin is overvalued or undervalued. By multiplying the current STH Realized Price (~$113,000) by historical MVRV thresholds, we can project potential resistance zones. And guess what? The data suggests potential resistance zones of $160,000 to $200,000 by the end of 2025! I mean, come on, folks, those numbers speak for themselves. Can you imagine the sheer excitement of seeing Bitcoin hit $200,000? I remember when it first crossed $1,000, I honestly thought that was the peak, and now look at where we are potentially headed – it’s just mind-blowing!Veteran Investors Signal: Get Ready for Liftoff!

Long-Term Holder MVRV Ratio: Insights from Experienced Investors The Long-Term Holder MVRV Ratio is also flashing bullish signals. By analyzing the behavior of the most experienced investors, we can gain insights into macrocycle dynamics. Applying historical diminishing return patterns suggests a potential peak around $163,000–$165,000. It's like the seasoned veterans are quietly loading up, knowing what's coming. This isn't just speculation; it's data-driven optimism.Rolling MVRV: Your Second Chance at Bitcoin?

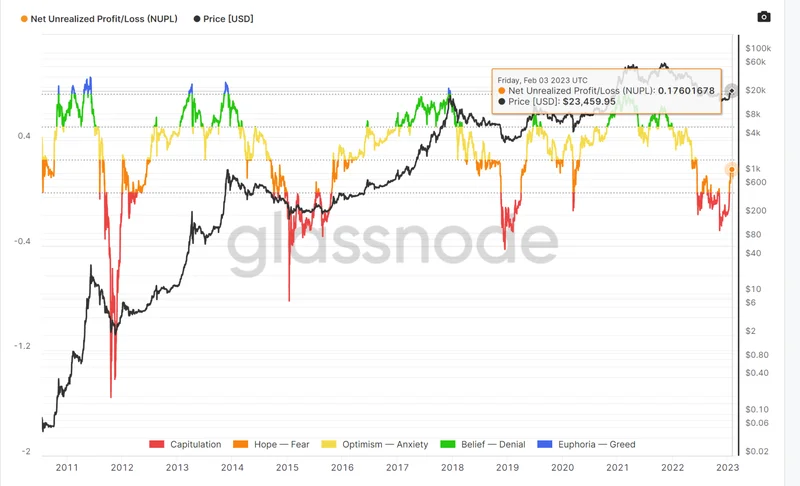

Rolling MVRV Framework: Accounting for Dynamic Market Changes And, of course, we need to talk about the Rolling MVRV framework. By viewing these ratios on a rolling basis, we can account for dynamic changes in market conditions. The MVRV Z-Score, when modeled on a 2-Year Rolling basis, eliminates some of the "diminishing peaks" seen in static models. Current readings are closer to the buy zone than the sell zone, implying that Bitcoin is *still* in an accumulation-friendly range. It’s like getting a second chance to buy your favorite stock at a discount – you’d be crazy not to take it, right?BTC's Bullish Signals: Is Crypto Ready to Roar Back?

BTC RSI MACD Signals: Hinting at Recovery The BTC RSI MACD current signals are also sending waves of excitement across the crypto community. These indicators, often used to track momentum and trend direction, now show a strong hint of recovery. The latest BTC RSI MACD current chart shows both lines aligning positively, hinting that the trend could soon move in favor of the bulls. This combination often appears before strong price movements. You can read more about this in "BTC RSI MACD Current Reveals Bullish Momentum: Are Bitcoin Prices Ready to Soar?".Bitcoin's Promise: Navigating Growth, Sharing the Future

Responsibilities and Concerns There's always a "but," isn't there? Look, this kind of parabolic growth comes with responsibilities. We need to be mindful of the environmental impact of mining and ensure that the benefits of this technology are shared equitably. But let's not let these concerns overshadow the incredible potential that Bitcoin represents.Forget the Fear: Bitcoin's Future is Already Unfolding

Conclusion: The Future is Here So, What Does This All Mean? It means the "death cross" is a distraction. It means the data is pointing towards a future where Bitcoin could reach unprecedented heights. It means that now is the time to be informed, to be optimistic, and to be ready for the next chapter in the Bitcoin story. The future isn't just coming; it's already here.