Mortgage Rates Today: What Today's Rates Mean for Refinance & Your Long-Term Plan

Okay, everyone, buckle up because I've got some news that's got my circuits buzzing – and should have yours too. We're seeing mortgage rates flirting with what some are calling the "lowest of the year." But let's be clear: This isn't just a blip, a minor dip before another climb. This is the starting gun for a whole new race!

The Calm Before the Quantum Leap

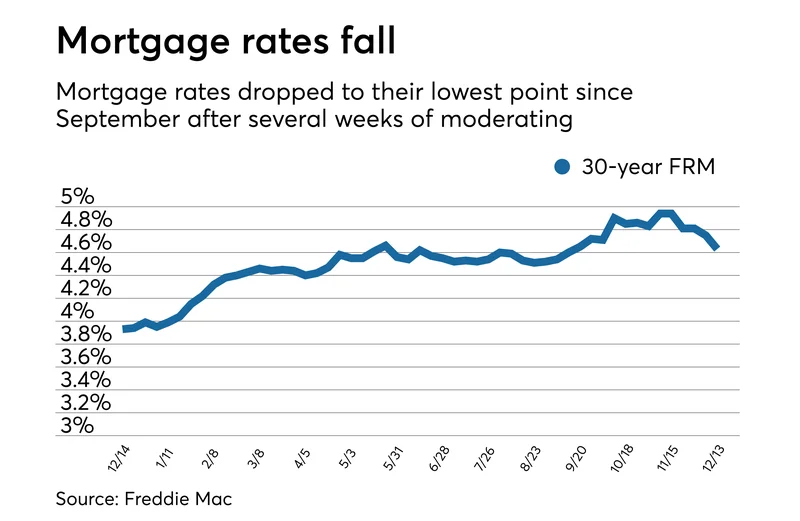

I know, I know, headlines are screaming about a slight decrease, five basis points here, a fraction of a percent there. Yawn. But here's what they're missing: the context. The Federal Reserve has been hinting—and then acting—on rate cuts. We've seen two already this year, with whispers (strong whispers!) of another to come. Think of it like this: the market is a super-cooled liquid, just waiting for that one tiny crystal to form, triggering a massive crystallization. That crystal? It could be this next rate cut.

And what does that mean for you?

Well, let’s paint a picture, shall we? Imagine a young couple, Sarah and Ben, dreaming of their first home. For months, they've been sidelined, watching rates hover like a hawk, ready to snatch away their affordability. Now, suddenly, that dream is back within reach. They can lock in a rate that doesn't just let them buy a house, but lets them breathe – invest in their future, start a family, live.

That's the human element often lost in the sterile data. The ability to finally live.

But it's bigger than just individual dreams. Think about the ripple effect. More buyers entering the market? Increased demand. Increased demand? More construction, more jobs, a healthier economy overall. It’s a virtuous cycle, folks, and we're just about to kick it into high gear.

I saw a quote floating around that economists "don't expect drastic mortgage rate drops before the end of 2025." Okay, fine. But "drastic" isn't the point. Consistent, sustained downward pressure is. It’s like the difference between a firework and a laser. One is a flash in the pan, the other cuts through steel.

And speaking of cutting through things… let's talk about refinancing. For those of you who jumped in when rates were higher (and let's be honest, that was most of us), this is your chance to rewrite the rules. A lower rate means lower monthly payments, yes, but it also means freeing up capital to invest, to innovate, to create. Current refi mortgage rates report for Nov. 24, 2025

It’s like upgrading the processor in your computer. Suddenly, everything runs smoother, faster, more efficiently. And who doesn’t want that?

Now, a word of caution, because with great opportunity comes great responsibility. We need to be smart about this. Don't overextend yourselves. Do your homework. Use those mortgage calculators (they're mentioned everywhere! [Keyword: mortgage calculator]) to play with the numbers, understand the implications. And for heaven's sake, read the fine print!

But even with those caveats, the potential here is undeniable.

Remember the printing press? Before Gutenberg, knowledge was hoarded by the elite. Information was scarce, expensive, controlled. The printing press democratized knowledge, unleashing a wave of innovation and progress that changed the world. This, my friends, is the financial equivalent. Lower rates democratize homeownership, empowering individuals, families, and communities.

What will you do with this newfound power? How will you use it to build a better future, not just for yourselves, but for all of us? That's the question we should all be asking.

I’m not the only one seeing the light here. I saw some comments online, and one really stuck with me: "This is our chance to finally build that home office I've always dreamed of, to launch my startup, to contribute to the new economy!"

That’s the spirit! That's the kind of thinking that will drive us forward.

Time to Dream Bigger

This isn't just about lower mortgage rates; it's about unlocking human potential. It's about creating a world where everyone has the opportunity to build a secure, fulfilling life. It’s about turning dreams into reality. And honestly, when I see these numbers trending downward, it reminds me why I got into this field in the first place. Mortgage Rates Drop Before Thanksgiving | Today, November 26, 2025