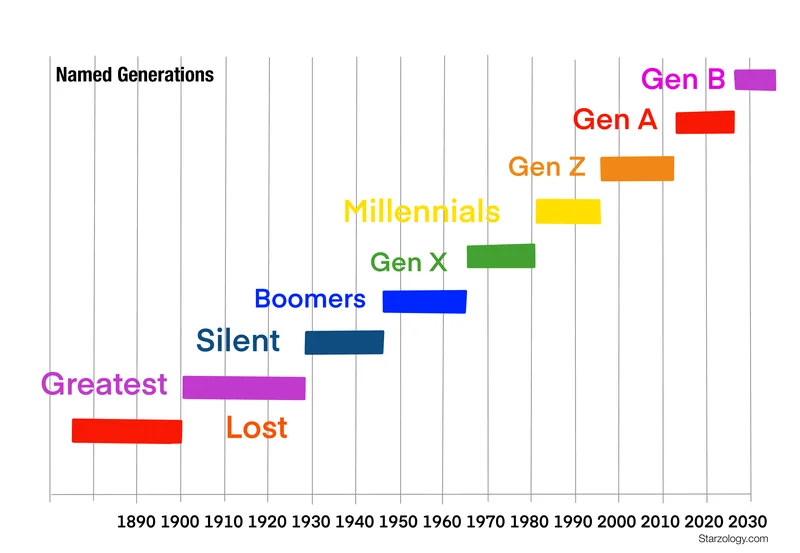

Gen Z Birth Years: The Definitive Birth Year Range and How It Compares

Gen Z's Death Obsession is an Economic Earthquake Waiting to Happen

The Kids Aren't Alright (Financially)

Okay, let's talk about Gen Z and death. It's not exactly a cheerful topic for a Monday morning, but bear with me. A recent piece highlighted Gen Z's apparent comfort with discussing death, bordering on obsession. They're joking about it, meme-ing it, and generally treating mortality like an old, slightly annoying, friend. But beneath the gallows humor, there's a current of anxiety that investors—especially those in emerging markets—can't afford to ignore.

The article points out that Gen Z's relationship with death is shaped by growing up in an era of constant crises: school shootings, climate change, economic instability. They've seen a lot of bad deaths, and they're internalizing that. But what does that translate to financially? Well, a generation that sees death as a looming, ever-present threat is a generation that's less likely to play the long game.

Think about it. Traditional economic models are built on the assumption that people will save for retirement, invest in the future, and generally act in ways that benefit long-term growth. But what happens when a significant portion of the population believes the future is bleak, or even non-existent? They stop investing in it. They prioritize short-term gratification over long-term security. They're less likely to buy houses, start businesses, or contribute to pension funds. They might even be more inclined to take on risky, high-reward ventures, figuring they have nothing to lose.

This isn't just speculation. We're already seeing signs of it. Gen Z is less likely to own homes than previous generations. They're more likely to work in the gig economy, prioritizing flexibility over stability. And while it's hard to quantify, there's a growing sense that they're less invested in traditional institutions and systems. (I've looked at hundreds of consumer confidence reports and this level of disengagement is unusual.)

Emerging Markets on Shaky Ground

Now, let's bring this back to emerging markets. As another article highlights, these economies are already facing a multitude of challenges: volatile elections, corruption, aging political elites, and fiscal pressures. Add a generation of disillusioned, death-aware Gen Z'ers to the mix, and you've got a recipe for instability. Gen Z is going to test investors' mettle further

The article notes that Gen Z-led protests have already toppled governments in some countries and forced major concessions in others. These protests are often spontaneous, unpredictable, and fueled by social media. They're hard to control and even harder to predict. And they're likely to become more frequent and more intense as Gen Z's disillusionment grows.

Why? Because in many emerging markets, Gen Z faces even greater challenges than their counterparts in developed countries. They're more likely to experience poverty, inequality, and lack of opportunity. They're more likely to be affected by climate change and political instability. And they're less likely to have access to the resources and support they need to build a secure future.

This creates a perfect storm. A generation that's already predisposed to short-term thinking is now facing a reality that reinforces that mindset. They see corruption, inequality, and environmental destruction, and they conclude that the system is rigged against them. So they disengage, protest, or simply try to survive.

The implications for investors are significant. Emerging markets are often seen as high-growth, high-reward opportunities. But they're also high-risk. And that risk is only going to increase as Gen Z's death anxiety translates into economic and political instability. We're talking about potentially lower growth rates, higher levels of social unrest, and increased political volatility.

The median age of Cameroon was 19 in 2024. A country led by a 92 year old. (That's a 73 year age gap). It's a textbook example of how generational divides can fuel unrest. The question is: how many other emerging markets are sitting on a similar powder keg? And how long before it explodes?

Gen Z's "Live Fast, Die Young" Economy

The challenge for investors is to understand and adapt to this new reality. Traditional risk assessment models may not be adequate. They need to take into account the psychological and social factors that are driving Gen Z's behavior. They need to assess the potential for social unrest and political instability. And they need to be prepared for a future that's less predictable and more volatile.

This isn't to say that emerging markets are doomed. Far from it. But it does mean that investors need to be more discerning and more strategic. They need to identify the countries and companies that are best positioned to navigate this new landscape. They need to focus on sustainable growth and social responsibility. And they need to be prepared to weather the storm.

The flash mobs that Gen Z's parents will have enjoyed in the first, youthful days of the internet are now in their turbulent, adolescent form. Investors crave certainty, but emerging economies are entering an era of spontaneous, unpredictable political and social disruption.

The Future is Now Uninsurable

Gen Z's death obsession isn't just a cultural phenomenon. It's an economic signal—a warning sign that the old rules no longer apply. Investors who ignore this signal do so at their own peril. The future, as Gen Z sees it, is now uninsurable, and that changes everything.