Mortgage Rates Today: Seizing Opportunity in 30-Year Fixed & Refinance Markets

Generated Title: Mortgage Rates Dip? Time to Stop Waiting and Build Your Dream Home

Seize the Moment: A New Chapter for Homeowners

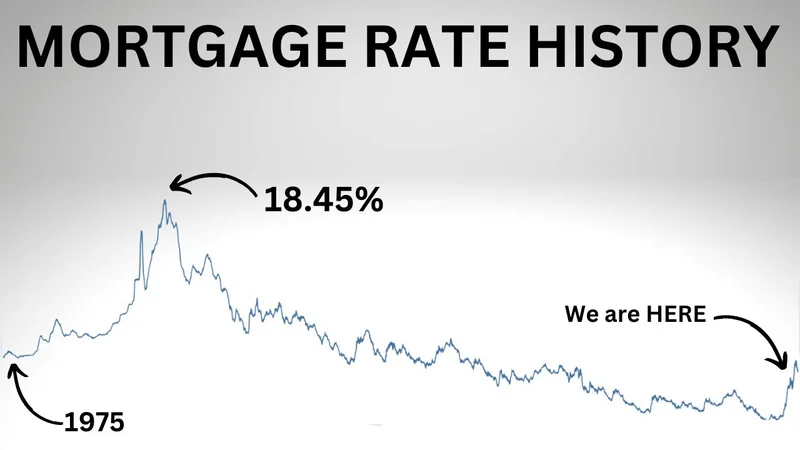

Okay, folks, let's talk about something that's been on everyone's mind: mortgage rates. I know, I know, it's not exactly the stuff of sci-fi dreams, but trust me, there's a quiet revolution happening here that could change the landscape of homeownership for you. We've been stuck in this holding pattern, watching rates fluctuate like a stock ticker, and honestly, it's been exhausting. But here's the thing: the latest data is showing a dip, a subtle but significant shift that signals it might just be time to stop waiting and start building that dream home.

According to recent reports, the average 30-year fixed mortgage rate is hovering around 6.04% [Zillow data as of late November 2025], with some sources even showing slightly lower numbers. And while those numbers might not scream "party time" compared to the rock-bottom rates of 2021, they are a welcome change from the peaks we saw just a few months ago. Sam Khater, Freddie Mac’s Chief Economist, put it well when he noted the resilience of homebuyer activity, even as we approach the end of the year. And you know what? I think he's onto something big.

But here's the really exciting part, the "Big Idea" that I want you to grasp: this isn't just about numbers; it's about opportunity. It's about the chance to finally take control of your future and create a space that reflects your dreams, your aspirations, your life. Think about it: for the past year or two, many of us have been sidelined, waiting for the "perfect" moment, the mythical rate that would magically make everything affordable. But what if that perfect moment isn't coming? What if the best time to act is now?

I saw a comment on a Reddit thread the other day that really resonated with me: "I'm tired of waiting for the market to be 'right.' I want to build a life, not just watch numbers." And that, my friends, is the key. We can't let fear of the unknown paralyze us. We need to embrace the present, make informed decisions, and take that leap of faith.

Now, I know what some of you are thinking: "But Aris, what if rates drop even further?" And that's a valid question. But let's be realistic: trying to time the market perfectly is like trying to catch lightning in a bottle. It's a fool's errand. What we can do is focus on what we can control: our credit scores, our debt-to-income ratios, and our ability to shop around for the best possible rates.

And speaking of shopping around, don't just settle for the first offer you see. Talk to multiple lenders, explore different loan options, and don't be afraid to negotiate. Remember, you're in the driver's seat here. As one article pointed out, Freddie Mac research indicates that homebuyers can potentially save hundreds or even thousands of dollars annually by comparing offers from multiple lenders. Mortgage and refinance interest rates today, November 26, 2025: 30-year rates dip as pending home sales rise.

But there's also a deeper ethical consideration here, isn't there? As we embrace these opportunities, we must also be mindful of responsible lending practices and sustainable homeownership. We need to ensure that everyone has access to fair and equitable housing options, regardless of their background or financial situation. This isn't just about building our own dreams; it's about building a better future for everyone.

And let's not forget the power of community. Find your tribe, connect with other homebuyers, and share your experiences. Together, we can navigate the complexities of the market, support each other's dreams, and create a more vibrant and inclusive housing landscape.